Three weeks ago, in Togo, I found myself in a bush hospital in Mango in the north of the country, after accidentally rupturing the cruciate ligaments in my knee .

I immediately called the insurance and assistance services of my Visa Premier card.

Mondiale Assistance (the organisation that covers you via the gold card) organised my repatriation, providing me with a private vehicle with driver from Mango to Lomé, a direct return flight in business class with Air France and a taxi from Roissy to my home .

I like to improvise when travelling, but there are some subjects for which it is essential tobe prepared. Insurance is a serious matter. Yet I still come across too many travellers without insurance.

I will always remember Ben.

It's not once you've had an accident that you have to ask yourself what to do. Being covered by a good insurance policy is not a matter of luck, it is up to you.

Contents

- 1 What is insurance for?

- 2 Isn't the French embassy supposed to help me wherever I am?

- 3 Are Visa Premier and Mastercard Gold good travel insurance?

- 4 Am I insured if I have a Visa or Mastercard?

- 5 Do I need to have paid for my flight with my card to be covered?

- 6 What are the guarantees of my bank card?

- 7 What is assistance?

- 8 What is insurance?

- 9 Does my bank card insurance cover my family?

- 10 In which countries am I covered?

- 11 Am I covered by health insurance while travelling?

- 12 Does insurance replace social security in terms of reimbursement of medical expenses?

- 13 What is the deductible on the reimbursement of medical expenses?

- 14 Is N26 Black a good travel insurance?

- 15 In which cases should I take out specific travel insurance?

- 16 What are travel insurances and their guarantees?

- 17 Which insurance is best suited to my situation?

- 18 What to do in case of an accident?

- 19 What should you have in your first aid kit?

- 20 Conclusion

What is the purpose of insurance?

Ask yourself, if you like:

- that your medical expenses are reimbursed during your trip?

- be taken to the nearest hospital or repatriated if necessary?

- be helped at any time to find a doctor abroad?

- be legally and financially covered for damage you may cause to a third party?

If you answer yes to one or more of these questions, you need insurance.

With my buddy Eric and my swollen leg in Lomé

Isn't the French embassy supposed to help me wherever I am?

Yes, but not at the expense of the state.

I invite you to see this in more detail on the website of the Ministry of Foreign Affairs.

To summarise, in the event of a serious accident, the consulate can inform your family and help you with your hospitalisation or repatriation, but you will still be responsible for the costs incurred .

For any action you plan to take, you need to present a financial guarantee.financial guarantee:insurance.

Are Visa Premier and Mastercard Gold good travel insurance?

Yes, for a stay of less than 90 days. It was Visa First Assistance that enabled me to be repatriated without any problems following my accident.

With my friend Dominique in Lomé

The guarantees are good, they cover your whole family and it's cheaper than travel insurance. Several online banks offer free visa premier or mastercard gold cards.

For more than 90 days, you need to take out specific travel insurance.

Am I insured if I have a Visa or Mastercard?

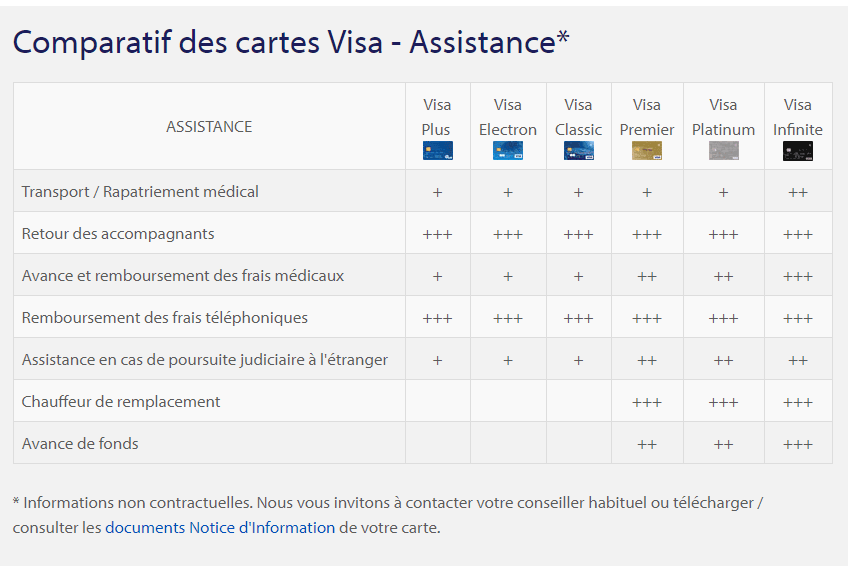

In part, contrary to what one might think, any visa card offers assistance guarantees. The guarantee for repatriation is the same for all cards, it is the amount of the other guarantees that changes: they are very low.

But you only have insurance benefits from the first card.

Do I have to have paid for my flight with my card to be covered?

Yes and no.

A distinction must be made between ASSISTANCE and INSURANCE:

The gold cards also guarantee you an insurance (to make it simple it concerns your travels). For this guarantee to work, you must have paid for your service with your card.

You can check this information on the official visa website, the official mastercard website and especially with your banker (ask him, it's very important). For N26 Black, for example, you have to have paid everything with it to be covered.

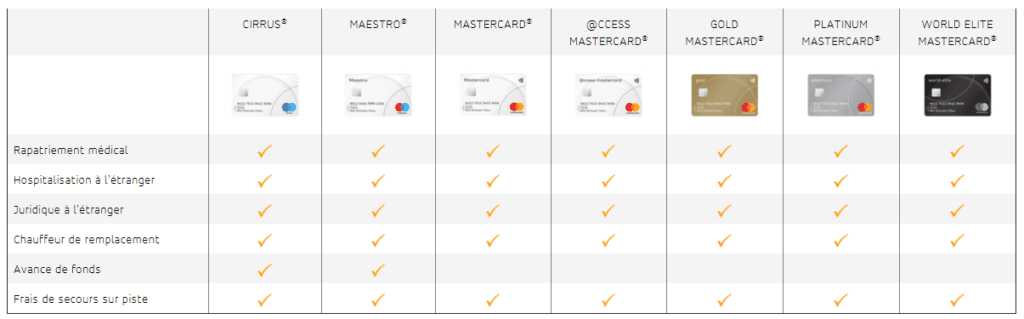

What are the guarantees of my bank card?

To cover you, I repeat myself, but it is essential that your card is valid. This is one of the things you should check before you leave.

Whether it's a basic card or a top-of-the-range card (premier, gold), it offers you and your family, whether or not they are accompanying you, assistance and insurance services .

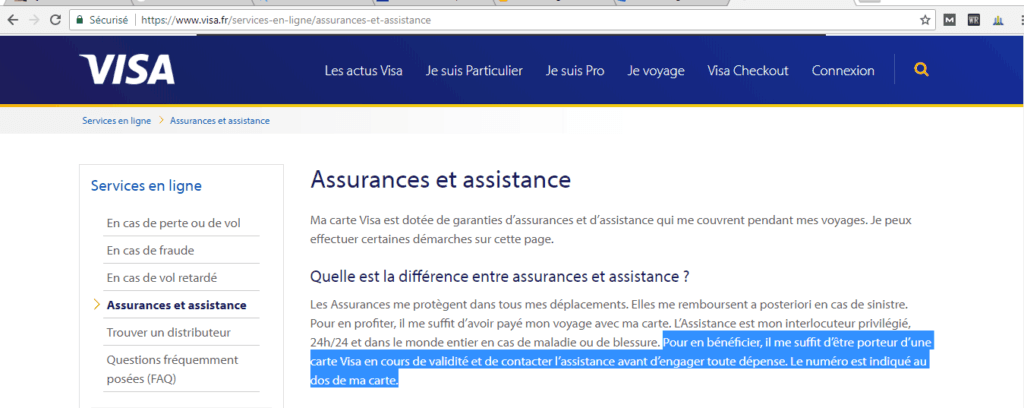

What is assistance?

- Medical assistance :

At any time, in France and abroad, you and your family benefit from medical repatriation assistance.

WITH NO SPENDING LIMIT FOR ANY TYPE OF CARD.

The gold cards allow you, if necessary, to have a driver to repatriate your vehicle.

-Medical expenses / hospitalisation + visit from a family member:

It covers your whole family.

This is where Gold cards come in. A basic card covers you for around €11,000 while a Gold card covers you for around €156,000 (which is what mine offers).

The Visa Premier and Mastercard Gold cards allow you to pay for a family member to come to your bedside if you are hospitalised for more than 10 days (plane ticket and hotel).

- Legal assistance abroad :

To defend yourself, your lawyer's fees (€15,500) and a criminal deposit (€15,500) are advanced. In case of damage caused to third parties, civil liability abroad covers you up to € 2 million) ALWAYS WITH GOLD CARDS.

In my case the assistance allowed me to have a private vehicle to go back down to the capital, an earlier than expected return in business class, to avoid an uncomfortable return in my flight in economy class, with 2 hours of stopover and a taxi in France to go back home. All this cost me nothing.

I also need to get reimbursed for my 80€ hospital bill, but that's going through the social security system first, it's ongoing.

DEPENDING ON YOUR BANK, YOU DO NOT NEED TO HAVE PAID FOR THE TRIP WITH YOUR CARD FOR THE ASSISTANCE TO WORK.

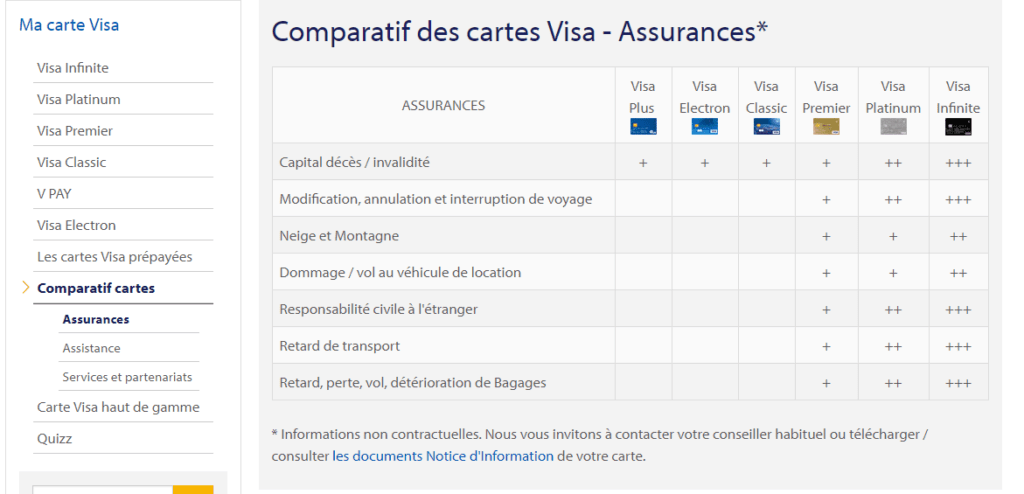

What is insurance?

The only guarantee covered by all the cards is :

Travel accident insurance: If you travel by public transport or rental car, you are covered up to

you are covered up to €310,000 in case of serious disability or death.

The rest of the guarantees are only available for Visa Premier and Mastercard gold cards:

- Trip cancellation/interruption insurance: you are covered for up to €5,000 in the event of

in case of illness or accident before departure or during your stay.

-Plane and train delay insurance: your expenses in the event of plane or train delays are

covered.

-Luggage loss, theft and damage insurance: your luggage is insured for a maximum amount of €850.

-Damage to rental vehicles: repairs or the amount of the excess are covered.

-Skiing special: your rescue costs on the slopes are covered. If you are unable to ski, your unused lift passes and lessons are reimbursed. Your rental equipment is covered.

My accident only involved assistance services, I did not have to use the insurance.

To benefit from these insurance guarantees, you must pay for these services with your bank card. This is ESSENTIAL.

Does my bank card insurance cover my family?

With my buddy Adam and my crutches from the bush in Mango

Yes, it covers your family according to the same rules as you (if they did not pay for the tickets with your card, only the assistance works).

By family we mean your spouse and your children under 25 years of age who are fiscally dependent on you, whether they travel with you or not.

They are covered by your assistance guarantees wherever they are:

For example: Your son going alone to Sri Lanka is covered by the assistance of your card. The same applies if your wife decides to go hiking alone in Kyrgyzstan.

Your unmarried grandchildren under the age of 25 are covered for the duration of your trip, if they are travelling with you.

In which countries am I covered?

Your card covers you in most countries.

If you have a Visa card, you can check and download a certificate at https://www.votre-assistance.fr/#/

For Mastercard and N26, you need to ask your bank.

For dedicated travel insurance, you will have a rate depending on your destination.

Visa insurance covers you in many countries, out of curiosity I tried it and mine covers me in Pakistan and Afghanistan.

Am I covered by health insurance while travelling?

If you are travelling in Europe, you need totake your European Health Insurance Card with you (apply online), which will allow you to prove your social security rights and to benefit from the coverage of your medical care on site.

In December, in Budapest, I injured my foot while playing football (my legs are very fragile these days). My ECA allowed me to avoid paying the hospital fees.

If you travel outside Europe,in case of medical care during your stay, you will have to pay your medical expenses there, keep your receipts and send back this form: Care received abroad.

On your return, reimbursement by the health insurance system will be a possibility, not an obligation. All this is detailed on the AMELI website here.

Does insurance replace social security in terms of reimbursement of medical expenses?

No, this is the subject about which there is the most misinformation.

Your bank card assistance covers you in addition to your social security and mutual insurance. It can advance you the sums necessary for your care during your stay but you will have to reimburse it.

In the end, it will reimburse you for the sums not covered by social security and your mutual insurance company.

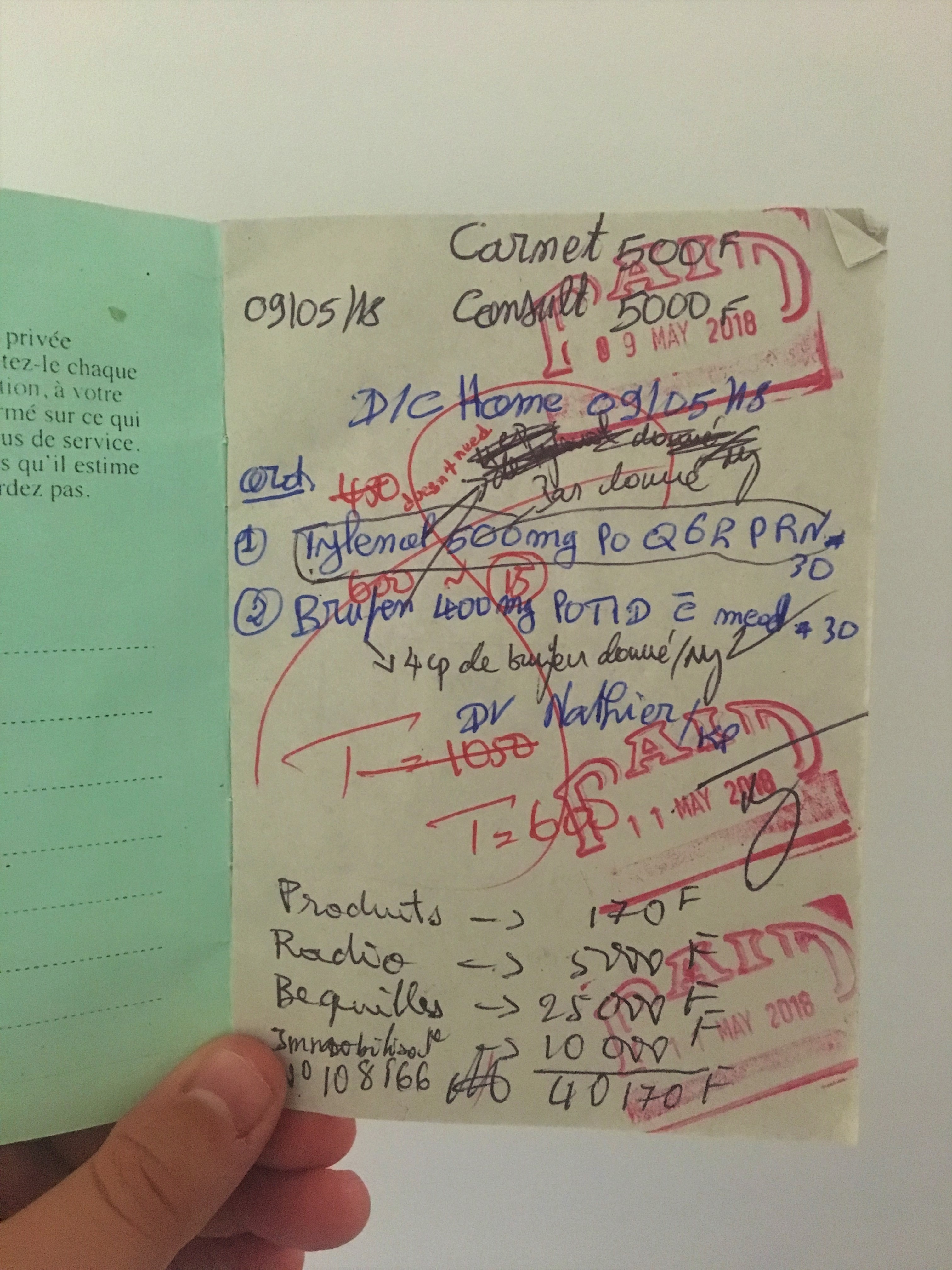

The bill for my stay at the hospital in Mango. Relic of this adventure.

The €156,000 of medical/hospitalisation cover on the Gold card allows you to have an advance payment in the event of costly hospitalisation. This is also the maximum amount that your insurance company will be able to reimburse you in addition to the sums received from the social security and your mutual insurance company.

This is where taking out travel insurance comes in handy:

Travel insurance offers coverage from the 1st euro without recourse to your health insurance and without deductible.

What is the deductible on the reimbursement of medical expenses?

Here again, the information is sometimes unclear. The excess for medical expenses is not €156,000 but €50 to €75 depending on the card.

To put it simply, this is a fixed sum that will be deducted regardless of the amount of your treatment.

An example with random numbers:

You are hospitalised in Thailand. The bill is €50,000.

The social security and the mutual insurance company will reimburse you €35,000.

Your insurance company will reimburse the rest minus the €50,000 excess = €50,000-€35,000-€50=€14,950 €.

You will get €50 out of your pocket.

The insurance company will reimburse you directly. In this case they would reimburse 50,000 without going through the social security system.

Is N26 Black a good travel insurance?

Yes and no, the problem with high-end cards is that they are income-tested.

If you're not familiar with it, N26 offers a premium card, N26 You, for €9.90 a month, with no income requirements, no deposit requirements and cheaper than travel insurance.

The insurance benefits are more limited, for me it is one of the best cards for withdrawals and payments. As far as insurance is concerned, it offers much less coverage than other cards.

ATTENTION, to benefit from the assistance and insurance guarantees you must have paid for your trip with your N26 card(see N26 general conditions )

I use the N26 Classic card, which is completely free, as a second card for travel. But I don't use it as insurance.

In which cases should I take out specific travel insurance?

A high-end bank card covers you sufficiently, but you need to take out dedicated travel insurance in these cases:

Your trip lasts more than 90 days.

You would like your medical care to be reimbursed from the 1st € without going through the social security system.

The costs of medical care are high in your destination: Canada and/or the USA. Most insurances offer higher guarantees for these countries.

What are travel insurances and their guarantees?

Below you will find the main insurance policies and their rates for trips of less than 90 days.

For trips longer than 90 days the rates and services offered are higher.

ACS, the cheapest, from €12 per month:

Repatriation: Actual costs

Medical expenses: 150 000 € max from the first € without advance payment

Assistance: 24 hours a day

Civil liability: €4.5 million

Chapka, the most comprehensive, from €22 per month.

Repatriation: Actual costs

Medical expenses: between €75,000 and €500,000 depending on the country of destination (see website for more details) from the first € without advance payment

Assistance: 24 hours a day

Civil liability: €4.5 million

The great advantage of travel insurance is that your medical and hospitalisation costs are covered from €1, without any advance payment.

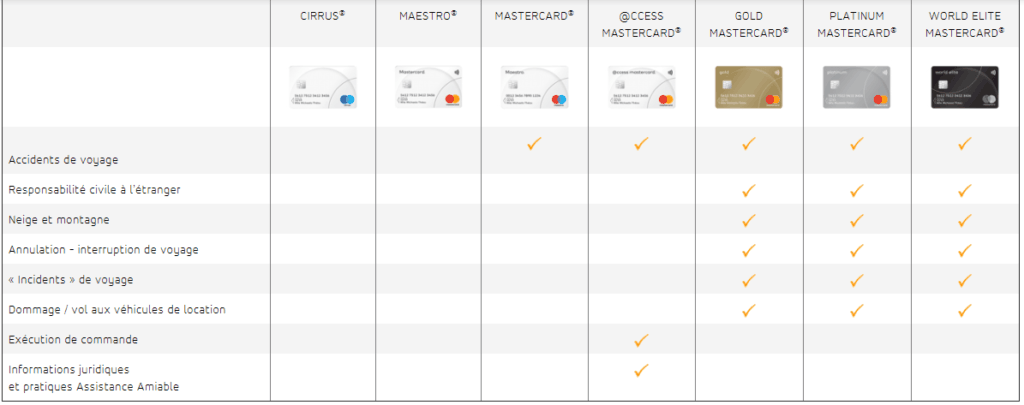

Which insurance is best suited to my situation?

In this table, you will find my summary of the essential guarantees offered or not by the high-end cards:

Hello bank,

Boursorama,

ING DIRECT

and N26

The data is extracted from the official documentation of each bank, which I have analysed at length and whose source you will find in this table.

At the bottom of this table, you will find a summary of these data.

If you are on a mobile phone and cannot navigate easily through the table, you can download it as a pdf, by clicking here.

Conclusion:

You meet the income requirements for a free gold card:

don't hesitate, it's the best solution.

If, like me, you stay abroad for 90 days and short weekends (it's just as important to be insured for a 3-day stay in Marrakech), your bank card insurance is the best solution. However, in case of hospitalisation you will have to deal with the administrative side of things with the social security.

It was my Visa Premier card that allowed me to be repatriated after my accident in Togo.

Hello Bank, Boursorama and ING offer almost equivalent guarantees with completely free gold cards.

ING offers the advantage of being more accessible, as the minimum income required is €1,200/month.

Hello Bank has the most comprehensive coverage.

Boursorama offers very good insurance and lower withdrawal and payment fees than its competitors

.

N26 Black offers much less coverage, the conditions of coverage remain unclear and it is not free. In this case, it is preferable to take a classic travel insurance such as ACS.

I advise you to take one of the 3 free cards:

I can sponsor you at ING.

You will receive 130€: 80€ referral bonus + 50€ of my referral bonus which I will transfer to you once my bonus has been received.

This will finance part of our next trip.

Just send me a message by clicking here:

On the other hand, N26 is perfect as a withdrawal and payment card. You don't have any fees.

So, I really advise you to take the basic free card which will allow you to save a lot of money on bank fees.

You are leaving for more than 90 days

Or you want your medical expenses to be covered from the 1st € without advance payment:

Acs is the most economical solution

Personally, I have the Visa Premier card because I always travel for less than 90 days and it allows me to be covered all the time without having to buy insurance when I go abroad for 3 or 4 days.

I also have a basic N26 card, which is free and allows me to have a backup solution in case I have a problem with my first means of withdrawal.(protecting your money when travelling is also a subject that should not be left to chance, I advise you to read my article on this subject)

How to act in case of an accident?

In case of an accident, depending on the situation, keep calm and contact your insurance as soon as possible before any urgent treatment.

This means that if you go to the doctor with a bad flu, you should ask your insurance company for permission beforehand.

If you have an open fracture, you can start treatment before you get your insurance.

When I had an accident in Togo, I went to the hospital and started to get treatment before calling the insurance company. My leg was bent in two, the pain did not allow me to call the insurance company. I contacted them once I had been given painkillers.

If you are in a country where the medical infrastructure is not good and you need important care, such as an operation, you should contact your insurance company and the French consulate. They will organise the most appropriate procedure for you.

The hospital where I was in Togo would not have been able to handle an operation. In case of a more serious accident I would have been evacuated directly by my insurance to a suitable facility.

What should you have in your first aid kit?

In case of need, my bag always contains my passport, my phone, a portable charger, a survival blanket, my bank card, some money and a micro-purifying tablet.

Your phone: It is essential to reach your insurance company and or embassy (pre-recorded numbers, that's why you should always buy a local chip). If you are in a place you don't know, Maps.meallows you to geolocate yourself and share your location, via a simple link.

Your mobile charger: When I arrived at the hospital, my phone was low on battery power. That's why the portable charger is so useful. In a hospital, there are sockets. But imagine yourself in an accident, alone in the wild. The portable charger will come in handy. See on amazon

A survival blanket: It takes up very little space and can protect you from heat, cold or damp. It is even strong enough to be used as a stretcher. It is the essential item to take with you on your trip. At less than 2 €, it would be stupid to do without it. See on Amazon

A box of micropur: When I arrived at the hospital I was given pills to take with water and overall I was very thirsty. Except that, in Togo, I didn't drink tap water without purifying it. I thought it wouldn't be very practical to end up with tourista while standing on one leg.

So, I really advise you to always carry some with you, in case of hospitalization, it will avoid you an additional problem. Check it out on Amazon

All your scanned documents:

Passport, flight ticket, visa on arrival. All these documents (as well as the medical report) allow your insurance company to validate your file. Except that in the north of Togo, the 3g is not so good. Fortunately I had put them on google drive and my sister was able to act as an intermediary in France to send them to my insurance company and speed up my coverage.

Having your passport on you allows the hospital to contact your embassy if you are unconscious.

Your medicines :

Remember to always have your medication with you. For example, I had my malaria treatment. In case of prolonged hospitalization, it would have allowed me to continue to protect myself against this disease.

Here is the list of essentials to be prepared in case of hospitalization abroad. Don't hesitate to tell me if you think any of them are missing.

In this situation, my insurance really relieved me. I just had to look after my health. Being alone, injured in a country you don't know is not the most pleasant thing. So having professionals available to help you is a real relief, which allows you to go through this kind of ordeal with peace of mind.

Conclusion

I hope I have answered your questions. In order to write this article, I have spoken to many people and read many articles. The information that circulates on the subject is not always good. My aim is to give you the best information, but don't trust me blindly, get information from your banker and compare the offers I have presented to you.

One thing is certain and my accident in Togo confirmed it. Travelling with insurance is essential.

If you have any questions or additional information, leave them in the comments, they will help enrich this guide.

April International covers COVID19 for repatriation unlike many others...

Hello

Interesting.

To update, I have a Visa Premier from Boursorama and the withdrawal and payment fees outside the EU zone are free.

Hello,

I am commenting as I have an ongoing case with N26 and Allianz. I have N26 BLACK since September 2019 and I pay 16,90€ per month. I had a motorbike accident in Laos at the end of January 2020. Nothing broken but had to go to hospital for an x-ray of the foot and ankle and swollen foot. I had of course bought everything with the N26 card: tickets and hotels. Since 27 January I have been sending them the documents (attention 4MO max otherwise they don't receive them, you think you are dreaming but no...). It's been 2 weeks since the accident.

The procedure already requires you to know your insurance policy number which is dedicated to you but which N26 does not give you by default (and it is not the general N26 black policy to download). So it's better to do it before leaving your country. I took a subscription Skype fixed and mobile renewable 1 month which saves my life in addition to a SIM UNITEL DATA in Laos. Thanks to this I can call them, as my emails were not answered... Otherwise you receive laconic emails asking you to send the documents to N26warranty.nl@allianz.com. I don't know how this will end with them. What is certain is that this is not assistance so fortunately through another FRENCH contract I had access to Inter Mutuelle Assistance who opened a file for me and I had a follow-up with advice from a doctor based in Niort. Allianz has a medical department which you can reach on +33 (1) 42 99 08 96 then 2 but I have not tried to speak to a doctor. I speak English but on most of my calls where I asked for French, it was difficult to get a French speaker. Then one really has the impression to be on line with an insurer ( Allianz ben Oui !!!! ). I will come back to make a comment at the end of the file

Thank you for your feedback, the most important thing is that you are fine. I know motorcycling well 🙂 You were lucky, that's cool. Keep us informed

Thank you for your support Georges Michel,

here is the news 2 hours later...

Thank you for your email.

Thank you for the documents. According to our T&C:

The Trip starts when the Beneficiary leaves his Country of Residence to travel directly Abroad.

The coverage of the Trip ends when the first of the following occurs:

When the Beneficiary returns Home.

When the N26 Metal Account validity expires.

90 days after the departure date

Please provide us all flying tickets - starting from your residence country and also the return ticket.

Thank you very much for understanding.

Looking forward to hearing for you.

Kind regards,

Allianz Global Assistance Europe

trading name of AWP P&C S.A. - Dutch Branch

In short, I have to finish my world tour in less than 90 days and not 91... And I have to provide the tickets for my return to France which I have not yet bought. Very well but I still don't know what will be taken in charge once I have provided all this (medical expenses, hotel, domestic plane to reach the hospital). In short, don't expect anything from the ALLIANZ N26 insurance...

Good evening,

I know a bit about Laos where I lived for 8 months (in Vientiane)

All my local expat acquaintances know and expect that at the slightest problem it's off to Thailand!

Lao hospitals are borderline....

As for me, I had taken a long term travel insurance with ACS.

good luck and a speedy recovery!

Thank you Karina for your comment. I didn't take out Globe Trotter insurance as I was leaving for 90 days, so I thought it would be fine. Unfortunately ACS doesn't accept your file as soon as you leave your country of origin and Chapka asked me for 200€ for my last 2 months, I took out a world option for 10€ with my mutual insurance company.

As for the hospitals in Laos, they are building a new one at the moment. I went to the French medical centre and met other westerners there. As I haven't broken anything and I've started cycling at the hotel gym yesterday, that's 3 weeks since the accident, I'm not too worried even if going down the stairs remains complicated.

I'm going to Auckland at the end of the month for a few days and then I'm going to Tahiti to visit my family and there it's a mess but it's France... I've been registering on Ariane since my accident because the Corona is still around...

In the meantime I have written to N26 who have taken my problem into account and to whom I must send documents, but in any case, until I return to France, no reimbursement whatsoever.

The ACS acceptance conditions must have changed then because I had not changed my tax reference country...

Good luck to you and have a good trip

Good evening,

I need a certificate of insurance corresponding to my first card to travel to Russia.

Thank you for your very complete articles, the blog is great!

I'm not sure if it's still worth it, but I'm sure it's a good idea to check out the N26 Classic card. On their website they indicate a commission of 1.7% and limited to 5 free withdrawals per month, so is it still worth it?

Hi, thanks for your comment. Banks' terms and conditions on withdrawals change often, so the reference is their website.

Thank you for this very comprehensive article, it helped me a lot 😉

It's very precise and very professional. If I open a blog I will mention yours because it is really complete. If you allow me to. Thanks again for all this information . ♀️♀️

Hi, thanks a lot for your compliments. Looking forward to reading your blog

Thank you for this very complete article and for your work in gathering information

Thanks for your feedback, it's cool

Hello,

I'm going to get a card from N26,

Do you want to sponsor me?

It will be a return for all this good info 😉

Karina

Hi, thanks with pleasure

Hello,

How did you see that there was an advance payment for the n26black for medical expenses?

Thank you in advance and great article!

Paul

Hi, thanks. I read that in the terms and conditions but if you have any doubts and as I say at the end of the article, the best thing is for them to confirm it in writing so that you are covered